Every insurance leader today is being asked the same question by boards and investors. How do we grow, control risk and improve margins while costs rise and customer expectations keep changing?

AI is often positioned as the answer. Yet many insurance organizations remain stuck between experimentation and real impact. Pilots show promise. Dashboards look impressive. But day-to-day operations still depend heavily on manual decisions, delayed approvals and disconnected systems.

This gap is not about technology maturity. It is about decision execution. Agentic AI addresses this challenge directly. It enables insurance systems to make informed decisions, take action within defined limits and involve humans only when judgment is truly required.

This guide is written for clarity before committing capital. It explains what agentic AI means for insurance, where it delivers measurable value, how risks are managed, and how leaders can approach adoption with confidence. The goal is simple. Help you make an informed decision, not a rushed one.

What Is Agentic AI in Insurance?

Agentic AI in insurance refers to AI systems that are designed to make decisions, take actions and adapt outcomes across insurance workflows, while operating within clearly defined business, regulatory and ethical boundaries.

In simple terms, agentic AI does not just analyze or suggest. It decides what needs to happen next and acts on it, with human oversight where required.

For insurance leaders, this distinction is critical. Traditional AI supports decision-making. Agentic AI executes decisions responsibly at scale.

That execution layer is what unlocks measurable operational and financial impact.

How Agentic AI Differs from Traditional Automation, Predictive AI and GenAI

Many organizations already use automation or AI in some form. This often leads to confusion about what is actually new here. The differences matter, especially when capital and risk are involved.

| Aspect | Traditional Automation (RPA) | Predictive AI / Machine Learning | Generative AI (GenAI) | Agentic AI |

|---|---|---|---|---|

| Primary Purpose | Execute predefined rules | Predict outcomes and probabilities | Generate text, responses, and content | Make decisions and take actions |

| Decision Capability | No decision-making | Suggests decisions only | Responds to prompts | Decides what to do next |

| Adaptability | Fixed logic, breaks when inputs change | Adapts through retraining | Adapts language, not actions | Adapts decisions based on context and outcomes |

| Action Execution | Executes scripted steps | No execution | No execution | Executes workflows autonomously |

| Human Involvement | Required for exceptions | Required for action | Required for execution | Human oversight only when needed |

| Use in Claims | Routes claims based on rules | Scores claim risk | Answers claim-related questions | Assesses, routes, escalates, or settles claims |

| Use in Underwriting | Applies static eligibility rules | Predicts risk score | Explains coverage | Requests data, adjusts pricing, or escalates cases |

| Use in Fraud Detection | Flags based on thresholds | Predicts fraud likelihood | Summarizes cases | Coordinates investigation and escalation |

| Compliance & Auditability | Limited traceability | Model-level explainability | Low decision traceability | Full decision logs and audit trails |

| Business Impact | Efficiency at the task level | Better insights | Improved interaction | End-to-end operational and financial impact |

| Strategic Value | Cost reduction only | Decision support | Experience enhancement | Scalable decision execution and ROI |

Why Are Insurers Moving Toward Autonomous Decision-Making Now?

For most leaders, timing matters as much as technology. Agentic AI is gaining attention not because it is new, but because business conditions now demand it.

Insurance margins are tightening. Loss ratios are under pressure. Operating expenses continue to rise faster than premiums in many segments. At the same time, regulators expect stronger governance, and customers expect faster, simpler experiences. This combination creates a leadership challenge.

This shift is happening for practical reasons, not trend-driven ones.

Insurance operations have reached a scale where human-only decision-making no longer keeps up with volume, complexity or cost expectations.

At the same time:

- Claims costs continue to rise

- Fraud tactics evolve faster than static rules

- Customers expect near-instant responses

- Regulators expect transparency, not black-box decisions

According to Accenture, insurers that embed AI-driven decision systems into core workflows can reduce operational costs by up to 40 percent while improving service consistency.

Agentic AI enables this by:

- Handling routine decisions autonomously

- Escalating exceptions intelligently

- Maintaining full auditability for regulators and internal teams

For CFOs and CEOs, this is not about replacing people. It is about deploying human expertise where it creates the most value.

The Financial Reality CFOs Are Managing

From a CFO’s perspective, the numbers are hard to ignore.

Claims handling, underwriting operations and policy servicing account for a significant share of operating costs. Even small inefficiencies multiply at scale.

Industry research shows that insurers using advanced decision automation can reduce operational expenses by 15 to 30 percent in targeted workflows. Yet many organizations fail to capture this value because insights never translate into action quickly enough.

Agentic AI closes that gap.

By enabling systems to decide and act within defined limits, routine decisions move faster, exceptions are handled intelligently and cost leakage reduces without sacrificing control.

Related Read: Agentic AI in Finance

This is not about cutting headcount. It is about improving cost per decision, which directly impacts expense ratios and profitability.

The Strategic View CEOs Need to Consider

For CEOs, the conversation goes beyond cost.

Growth, customer trust and competitive differentiation are increasingly shaped by operational speed and consistency.

Customers compare insurers not just with peers, but with digital-first brands across industries. Delays in claims resolution or policy changes erode trust quickly.

Agentic AI enables organizations to deliver:

- Faster turnaround times

- Consistent decision logic across channels

- Scalable service quality without linear cost growth

More importantly, it allows leadership teams to move from reactive operations to proactive orchestration.

Decisions no longer sit in queues waiting for human availability. They move forward with clear accountability and oversight.

Why Investors Are Paying Attention?

Investors increasingly look at operational resilience, not just growth projections.

Organizations that depend heavily on manual decision-making face higher execution risk during demand spikes, regulatory shifts, or economic stress.

Agentic AI improves resilience by:

- Reducing dependency on manual bottlenecks

- Improving predictability of outcomes

- Creating auditable decision frameworks

From an investor standpoint, this signals maturity in digital operations and risk management.

It also shortens the path from strategy to execution, which is often where value is lost.

Why “Now” Matters More Than “Eventually”

Some leaders ask whether it is better to wait.

The risk with waiting is not missing technology. It is missing organizational readiness.

As regulations around AI governance tighten, early adopters gain experience in explainability, oversight, and compliance. Late adopters face steeper learning curves under greater scrutiny.

Starting now allows insurers to:

- Pilot in low-risk workflows

- Build internal confidence

- Establish governance frameworks early

- Scale with control, not urgency

What This Means for Decision-Makers

Agentic AI is not a speculative investment. It is a response to very real operational and financial pressures.

For CFOs, it offers measurable cost control.

For CEOs, it enables scalable execution and differentiation.

For investors, it signals resilience and long-term value creation.

The leaders who benefit most are not those who rush, but those who start with clarity.

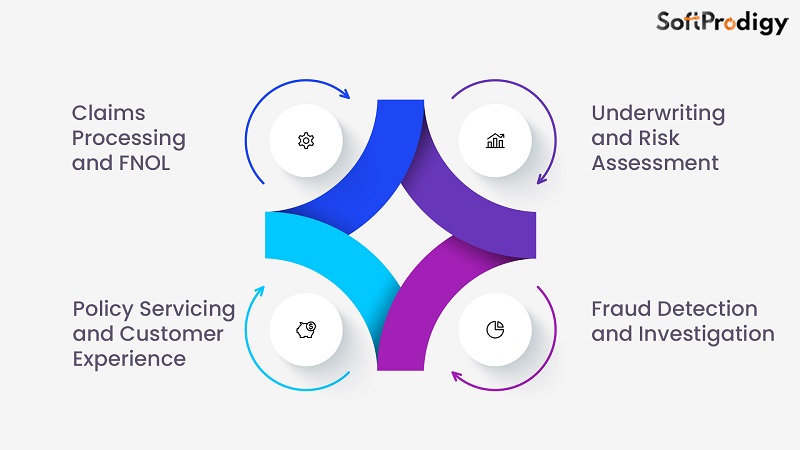

Real-World Use Cases of Agentic AI in Insurance

Understanding the concept is important. Seeing where it creates impact is what drives decisions.

Agentic AI delivers value where insurance workflows involve high volume, repeated decisions and time pressure. These are the areas where manual processes slow growth and increase cost.

Claims Processing and FNOL

Claims are the largest operational expense for most insurers.

Agentic AI helps by managing decisions across the claims lifecycle. From first notice of loss to settlement, AI agents can validate coverage, assess complexity, flag fraud risk and decide whether a claim can be processed automatically or needs human review.

This reduces unnecessary handoffs and speeds up resolution.

Insurers using AI-driven claims decision orchestration have reported 20 to 30 percent reductions in claim cycle time. Faster settlements improve customer satisfaction and reduce administrative costs.

Underwriting and Risk Assessment

Traditional underwriting often relies on static snapshots of risk.

Agentic AI introduces continuous assessment. AI agents monitor incoming data, request additional information when needed, and escalate complex cases based on predefined confidence levels.

This allows underwriters to focus on judgment-driven cases instead of routine reviews.

For leadership teams, this translates into faster quote turnaround, better risk alignment and improved portfolio performance.

Fraud Detection and Investigation

Fraud teams struggle with volume more than capability.

Agentic AI coordinates multiple agents to assess patterns, behaviors, and historical data before deciding whether an investigation is warranted. Only high-confidence cases are escalated.

Industry studies show insurers using AI-led fraud orchestration can reduce manual investigation effort by up to 50 percent while improving recovery rates.

This protects margins without increasing team size.

Policy Servicing and Customer Experience

Policy servicing is often overlooked, yet it is a major cost center.

Agentic AI enables autonomous handling of routine requests such as endorsements, renewals and coverage changes. Decisions are validated, executed, logged and audited automatically.

Customers receive faster service. Teams spend less time on repetitive work. Compliance remains intact.

How Agentic AI Fits into Existing Insurance Systems

A common concern among leaders is whether agentic AI requires replacing core platforms.

In reality, it does not. Agentic AI sits on top of existing systems, integrating with policy administration, claims management and data platforms.

A typical setup includes:

- Access to internal and third-party data

- Decision orchestration logic

- Defined confidence thresholds

- Human approval checkpoints

- Audit and monitoring layers

This makes adoption incremental and controlled rather than disruptive. For decision-makers, this reduces implementation risk and shortens time to value.

Governance, Risk and Compliance Considerations

Governance is not optional in insurance. Agentic AI must be designed to answer three critical questions:

- Why was this decision made

- Who approved or overrode it

- Can it be explained to regulators and customers

Well-governed systems include:

- Transparent decision logic

- Bias monitoring

- Escalation rules

- Full audit trails

This approach aligns with US regulatory expectations and supports responsible AI adoption. Leaders who prioritize governance early avoid costly rework later.

Measuring ROI from Agentic AI Investments

Agentic AI should be evaluated like any other strategic investment. The most common metrics include:

- Reduction in claims cycle time

- Cost per claim

- Loss ratio improvement

- Fraud recovery rates

- Customer satisfaction scores

Most insurers see measurable returns within six to twelve months when agentic AI is applied to focused, high-impact workflows. The biggest mistakes happen when organizations try to automate everything at once instead of starting with clear priorities.

Build or Buy, Making the Right Strategic Choice

There is no single right approach. Buying platforms accelerate deployment. Custom development offers flexibility and deeper integration.

Many insurers succeed with a hybrid model. They use proven platforms where possible and extend them with custom agent logic where differentiation matters.

The right decision depends on scale, complexity, and long-term strategy.

A Practical Implementation Roadmap for Leaders

For leaders considering next steps, a phased approach works best. Start by identifying one workflow with high volume and clear ROI. Define decision boundaries and governance rules. Pilot with measurable KPIs. Scale gradually once confidence is established.

This reduces risk and builds internal alignment.

Final Takeaway,

Agentic AI is not about replacing people or chasing trends. It is about executing decisions faster, more consistently and more responsibly.

For CFOs, it improves cost efficiency. For CEOs, it enables scalable growth and differentiation.

For investors, it signals operational resilience and maturity.

The leaders who benefit most are those who start with clarity, not urgency.

If you are evaluating how autonomous decision-making fits into your insurance strategy, now is the right time to explore it thoughtfully.