Financial apps make managing money convenient and hassle-free. However, it is crucial to keep them secure.

There are several types of financial apps that can perform a multitude of functions from investing to checking bank balances and everything in between. It is not surprising why so many people rely on these applications, given how easy and straightforward they are. Nevertheless, because so many people use financial applications, there’s no doubt that the risk of cyber threats will rise.

Hackers are always in search of methods that will let them steal important details, including personal information and back account numbers. Henceforth, in order to help the users keep their information and data safe, it is essential to perform thorough web application interface testing.

To all those who do not know, web application interface will check how a financial application works. In addition to this, it also helps in finding out if the users can navigate through the apps in the right manner. It focuses on ensuring that all the features work properly, and that users can interact with the apps conveniently.

When it comes to financial apps, usability is also important because even a small mistake will give rise to major problems, and wrong transactions are one of them.

Understanding Everything About Financial Web Application Interface Testing

Financial applications are software systems. They assist in managing a great deal of financial activities and transactions, such as management and access to investments, online banking, and others.

The apps play a significant part in the modern digital economy, providing all users with an opportunity to manage funds, investments, and settlements without any difficulties.

One common type of financial app is online banking. It helps the users to send funds, pay bills, and manage accounts without having to visit a bank now and then. Furthermore, financial applications have also replaced traditional banking methods due to its efficient services.

Online investment platforms and portfolio management tools enable buying and selling of stocks while keeping track of investments, making predictions about future trends in the market.

Another famous category is payment applications, which has made it simple for users to send and obtain payments without wasting any time. There is no need to visit a bank and take out money.

A single click will do all the work. Apart from this, loan management platforms have also helped users apply, manage, and track their loan applications, simplifying what was once a very difficult procedure.

Because of the sensitive nature of the details processed, the applications need to be safe and secure. They managed data like account number, credit card details, personal information, and password. If taken for granted, users can come across issues like financial fraud and identity theft, resulting in illegal access to accounts, loss of funds, and fraudulent transactions.

Doubtless, protection for financial applications is considered to be one of the most important concerns in recent times. This is not only for the safety of the user but also establishes the base for trust among financial institutions. In case of security breaches, financial loss can take place.

Additionally, the reputation of financial institutions can also be harmed. So, vulnerability testing, authentication, and encryption need to be incorporated to offer protection to financial apps against possible threats.

Why are Financial Applications Vulnerable?

Did you know that financial applications are prime targets for cyberattacks because of a number of vulnerabilities? The amount of data they manage makes them attractive to cybercriminals. Hackers most of the time want to steal all the essential information, which can easily be sold on the dark web and can be used for fraudulent activities.

Another cause is the inherent complexity of financial applications. Such an application would encompass many layers of functionality-such as user authentication, transaction processing, and data encryption-all possibly under proper integration. The more complicated the system, the tougher it becomes to identify and plug all remaining security holes.

The other challenge is frequent updates. Financial institutions have to keep updating their applications due to compliance with different regulations or for adding new features.

In the process of updating applications, the introduced bugs or security flaws may open up ways for attackers to exploit them. Even a small change in codes may open the space to vulnerabilities when tested.

Financial institutions have to be proactive with web application interface testing in efforts to beat these risks. Web interface testing is useful because it helps ensure different components in a financial application communicate safely and do exactly what they are supposed to. Problems can be identified before an attacker can exploit them.

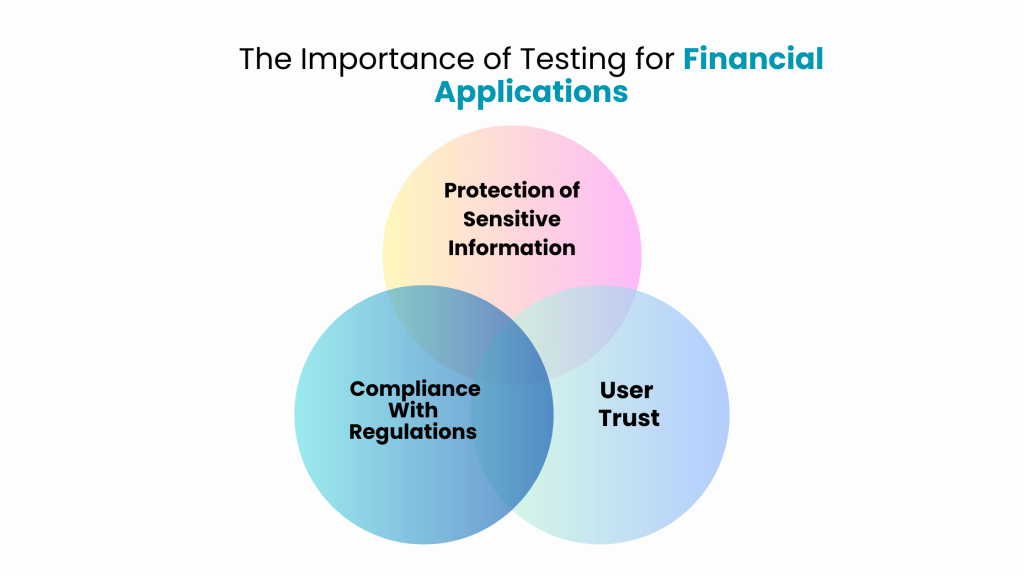

The Importance of Testing for Financial Applications

Here are all the reasons why testing for financial application is of utmost importance and should not be taken lightly:

1. Protection of Sensitive Information

Web application interface testing identifies security vulnerabilities in a financial system even before hackers exploit them. Every aspect of the application under test is tested to ensure that its sensitive data remain protected from hackers’ access.

For example, such tests may reveal whether credit card numbers and PINs are intercepted or misused. Early correction of the vulnerability protects the sensitive information of users from being misused, thereby preventing losses or fraud resulting from such systems.

2. User Trust

Users, when logging into financial apps, expect their personal and financial data to be safe. Weak security can compromise the information of a user, where he or she might lose confidence in the application as well as the financial institution it is associated with.

Web interface testing on regular updates makes sure that the application is safe and reliable. It is only when they are assured that their data is safe that the users will make continued use of the app, hence still recommending it to others.

3. Compliance With Regulations

Strict regulations ensure the data provided by users is secure. Most financial applications must undergo testing at regular times to meet up with the security requirements for financial institutions.

The process of web application interface testing assists companies in maintaining compliance with such regulations, avoiding hefty fines or even legal action due to non-compliance.

Testing beforehand ensures that the applications developed by financial institutions meet all the required security standards and protects both the users and the institutions’ reputation.

Types of Web Application Interface Testing for Financial Applications

All the below testing activities can be performed by experts using different varieties of web interface testing techniques. Here are those:

1. Functional Testing

Functional QA testing services ensure that all the features and functions of the application are done as expected. In this case, it checks whether the buttons, forms, and links are working effectively. In this case, it checks whether the buttons, forms, and links are working effectively.

This is important in financial applications to ensure that processes such as transactions, account updates, and data submissions work without glitch. What might happen is that a bug in the functionality causes enormous issues, such as incorrect disbursements or statements.

2. Usability Testing

It tries to find out just how user-friendly the application is. Here, with financial applications, the user would be working on complex tasks such as investment management or bill payments. Hence, the application needs to be friendly enough so that the navigation is simple.

This will help discover confusion areas in the application for the mind of the user and points where it is not going to be easy to use hence making it much easier for others with less expertise in technology.

3. Performance Testing

This test shows how the application will behave under different conditions, say, high traffic or poor internet speed. Any financial application should be stable and fast and is at its peak during certain times of the year like the last days of the month or holidays. You want your application to respond as expected, handle load stress, and hold up robustly without crashing down or slowing down.

4. Security Testing

Security testing services are crucial to check possible vulnerabilities hackers might use against you. Financial applications store their sensitive data. Therefore, security testing helps in the protection of such data from fraud, breach, and unauthorized access threat. This makes sure that user data stays safe, and trust and costly security incidences are prevented.

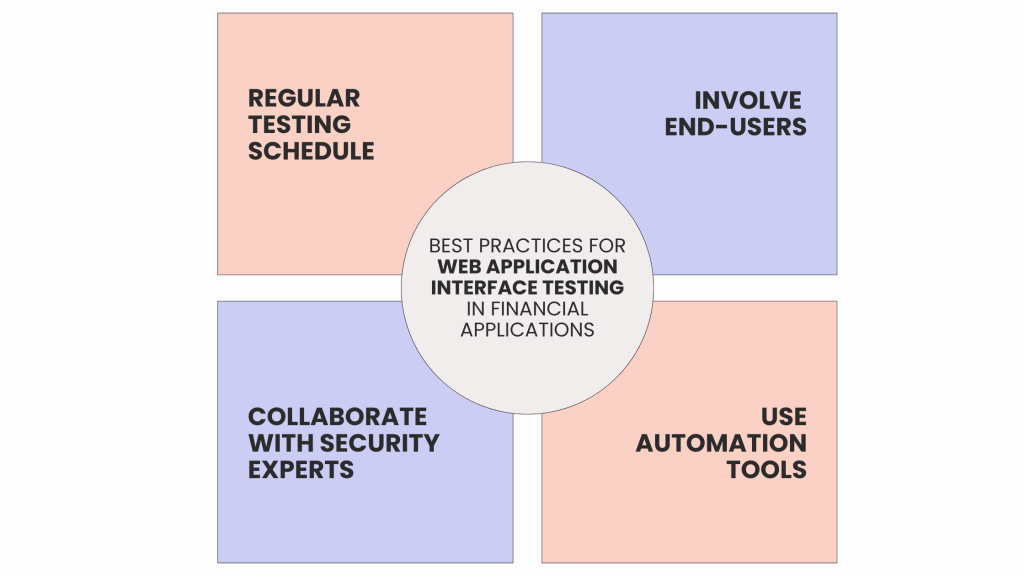

Best Practices for Web Application Interface Testing in Financial Applications

Using the best practices for testing financial applications can improve the security and functionality. Here are some of the best practices:

1. Regular Testing Schedule

Financial Institutions must undertake major steps in the testing process to prevent the occurrences of cyber threats in the financial applications. Firstly, there must be a scheduled test program. Applications developed by financial institutions should not only be tested at the beginning, but also periodically evaluated upon making changes to the application.

This helps to persistently identify vulnerabilities that may emerge after some time from the inception as new features are introduced. This testing may therefore become part of the routines of the organizations, and problems would be identified and corrected early.

2. Involve End-Users

Another very crucial step is to include the end-users in the testing process. This is because these users interact with the application on a daily basis; hence, they are more likely to give information regarding usability and security gaps in such an application.

Sometimes, developers may even miss certain issues that may only arise during real usage. Institutions can, therefore, understand better what needs to be improved to make such an application more secure and friendly for use by gathering such information.

3. Use Automation Tools

Along with automation tools, testing efficiency can also be increased. Automated testing tools can run different tests fast, thus helping find problems more quickly than when using manual testing.

These automated testing tools also give detailed reports that can be used by developers to rectify any type of problem, thus making the entire process smoother and more effective.

4.Collaborate with Security Experts

The involvement of security experts might make the testing process much better. The experts can give the organization the information about the most recent threats and vulnerabilities, thus ensuring that such elements are taken into account in the latest testing methods.

The Last Thoughts

Altogether, web interface testing forms an essential role in protecting financial applications from cyber threats. Cyberattacks rise and become more dangerous over time. Therefore, financial institutions need to ensure they perform the web app interface testing regularly to establish whether vulnerabilities could be exploited before they affect operations and ensure customer trust is maintained due to safe sensitive financial information.

Web application interface testing can be used by financial institutions to ensure that systems are secure, running smoothly, and offer adequate protection to users. Testing identifies potential security gaps and usability issues; the application does not only protect the users but also offer a smooth experience. Organizations should always observe the best practices, including scheduling regular testing, involving end-users, using automated tools for testing, and collaborating with security experts. These steps add to the overall security of the financial applications and further withstand new threats.

Proper testing services or methods are no longer an option, but an absolute necessity for any institution involved in monetary transactions. A strong and secure application is both about protecting data and proving to be the foundation for increasing customer satisfaction, because it becomes a trusted platform.

SoftProdigy is here to assist you. We are experts in web application interface testing. We’ll work up customized testing solutions to suit the needs of financial applications to ensure it’s secure, reliable, and user-friendly. Get in touch with us. Let’s protect systems, keep the customers’ data safe, and build a more secure future together.

FAQs

Why is interface testing necessary for financial applications?

Interface testing keeps up data integrity, security and other aspects of a smooth-working financial application without an instance of error or vulnerability.

What does interface testing do towards enhancing the security of financial applications?

It detects lost connections, data breaches or access points without authorization and guards sensitive financial data against cyberattacks.

Can interface testing prevent data loss in financial applications?

Yes, that is partly because of the prevention of loss of data, since the process might sometimes make a loss if improper information transmission and processing occur between different modules.

How often should financial apps be interface tested?

Financial applications should be readily interface tested, especially after updates or change regarding the security and functionality issues

What are the main aspects that are tested on the web application interface?

The keys include APIs, databases, and UI elements, which play crucial roles in performing functions properly in financial applications.